In the fast paced world of personal finance, LendingClub MyInstantOffer function offers an easy way to secure personal loans up to $40,000. This platform is well known for its simple login process and quick access to funds, providing a lifeline for a variety of financial requirements, including debt consolidation and home improvements.

Myinstantoffer Online Loan 2024-25 Overview

| Feature | Details |

|---|---|

| Loan Amount | Up to $40,000 |

| Loan Term | 36 or 60 months |

| Interest Rate | Varies based on credit score and other factors |

| Pre-approval Code | Required for application initiation |

| Application Process | Entirely online at MyInstantOffer.com |

| Credit Score Requirement | Minimum 600 |

| Security Measures | SMS-based verification during login |

Pre Requisites for MyInstantOffer LendingClub Login

- Pre-approval Code: Essential for logging in; start by obtaining this code to access the portal and begin the application.

- Account Setup: Register at MyInstantOffer.com, creating a username and password.

- Personal Information: Provide full name, address, date of birth, and social security number during registration.

- Financial Details: Input your net annual income and credit score to receive tailored loan offers.

- Electronic Device: Use a device with internet access to navigate and complete processes.

- Email Address: Ensure a working email is linked to receive notifications and account recovery options.

- Security Measures: Verify your identity through SMS during login for security.

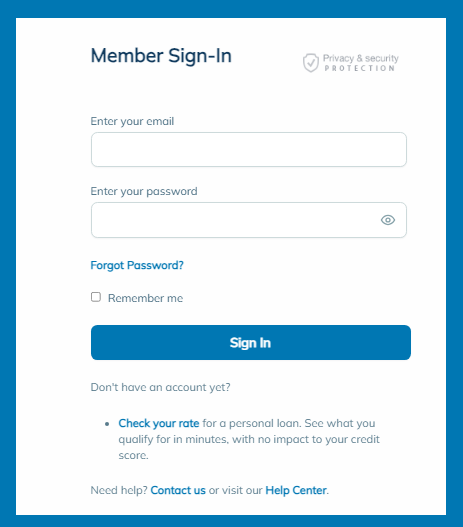

How do I access my LendingClub account online?

Guide on how to access your LendingClub account online:

- Visit the Website: Go to LendingClub’s official website.

- Locate the Login Page: Click on the ‘Sign In’ link typically located at the top right corner of the homepage.

- Enter Your Credentials: Type in your username and password in the respective fields on the login page.

- Secure Login: Complete any required security verifications, which may include answering security questions or entering a code sent via SMS(LendingClub).

- Access Your Dashboard: Once logged in, you will be directed to your account dashboard where you can manage your loans, view your account details, and perform other financial activities.

You May Also Like:

Eligibility Criteria for MyInstantOffer Lending Club

Apply for MyInstantOffer Pre-Approved Loans

Is it hard to Get approved for LendingClub?

- Credit Score Requirements: A minimum of 600 is required, with better scores increasing acceptance chances.

- Debt to Income Ratio: Should be low in order to demonstrate reasonable monthly payments alongside existing debts.

- Income Verification: Stable, verifiable income is required to establish repayment capability.

- Loan Purpose: Approval may be based on the loan’s purpose, such as debt consolidation or house upgrades.

- Previous Financial Behavior: A track record of on time payments and responsible credit usage is beneficial.

Conclusion

MyInstantOffer by LendingClub stands out as a strong option for people looking for personal loans with adjustable terms and a simple application process. Users may efficiently manage their financial demands by logging in securely and researching the many loan possibilities.

FAQs

Q1. What is the minimum credit score required to get a LendingClub loan?

Ans: A minimum credit score of 600 is often necessary for acceptance.

Q2. Can I use a LendingClub loan to consolidate debt?

Ans: Yes, debt consolidation is one of the most typical reasons for acquiring a LendingClub loan.

Q3. How would monitoring my LendingClub rate effect my credit score?

Ans: Checking your rate requires a soft credit draw, which has no impact on your credit score.

Q4. What is the maximum amount I may borrow from LendingClub?

Ans: LendingClub provides personal loans for up to $40,000.

Q5. How long does it take to receive funds from LendingClub after approval?

Ans: Funds are normally put into your bank account within a few days of loan approval.